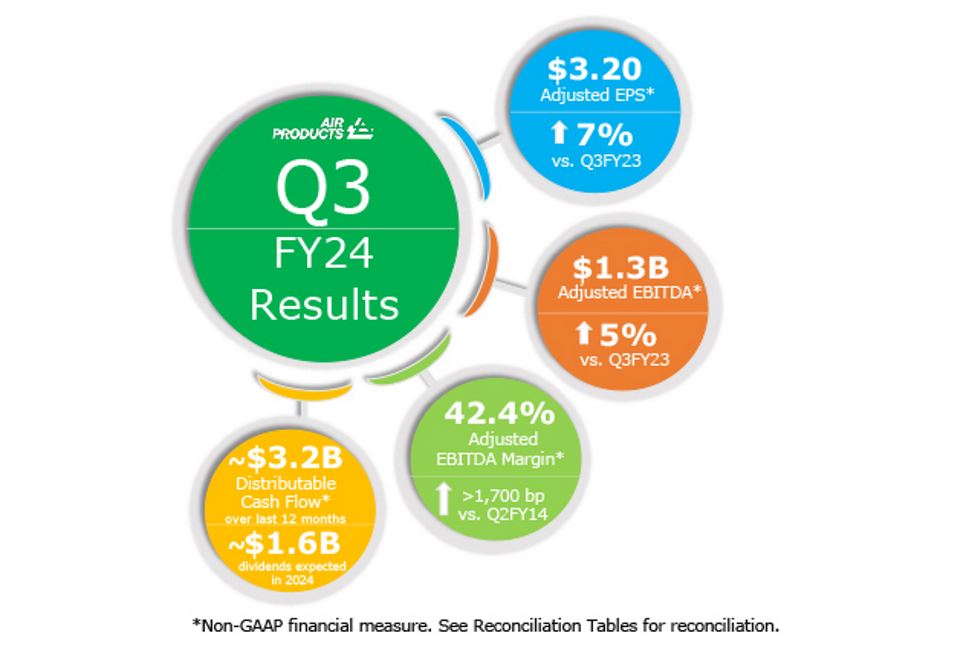

Commenting on the results, Air Products' Chairman, President and Chief Executive Officer Seifi Ghasemi said, "Our third quarter adjusted EPS of $3.20 exceeded our previous guidance and increased seven percent over the prior year, driven by Americas and Europe operating performance as well as pricing and productivity actions. The results demonstrate our focus on running our core industrial gas business, and our adjusted EBITDA margin is the best in the industry. We announced significant milestones during the quarter, including the long-term renewable hydrogen supply agreement with TotalEnergies, which validates our strategy and the expected growth in the clean hydrogen market. As always, our results reflect the hard work of our dedicated and talented employees, and I want to thank them for their contributions."

Fiscal 2024 Third Quarter Results by Business Segment

- Americas sales of $1.2 billion were down two percent versus the prior year due to three percent lower energy cost pass-through, one percent lower volumes, and one percent unfavorable currency, which were partially offset by three percent higher pricing. Operating income of $391 million increased four percent and adjusted EBITDA of $604 million increased six percent, in each case primarily due to higher pricing. Operating margin of 31.7 percent increased 200 basis points and adjusted EBITDA margin of 48.9 percent increased 390 basis points, each of which included positive impacts of approximately 100 basis points from lower energy cost pass-through.

- Asia sales of $790 million decreased four percent from the prior year primarily due to four percent unfavorable currency and one percent lower volumes, as lower demand for merchant products and planned maintenance outages were partially offset by new assets. These impacts were partially offset by one percent higher energy cost pass-through. Operating income of $200 million decreased 17 percent and adjusted EBITDA of $324 million decreased nine percent, in each case primarily due to the planned maintenance outages. Operating margin of 25.3 percent decreased 400 basis points and adjusted EBITDA margin of 41.1 percent decreased 220 basis points.

- Europe sales of $693 million decreased two percent from the prior year as two percent lower energy cost pass-through and one percent unfavorable currency were partially offset by one percent higher volumes. Operating income of $205 million increased 16 percent and adjusted EBITDA of $283 million increased 12 percent, in each case primarily due to increased volume, primarily from new assets, and pricing, net of variable costs. Operating margin of 29.5 percent increased 460 basis points and adjusted EBITDA margin of 40.8 percent increased 490 basis points.

- Middle East and India equity affiliates' income of $89 million decreased seven percent compared to the prior year, primarily due to higher costs.

- Corporate and other sales of $235 million increased 15 percent compared to the prior year, primarily due to higher LNG and other sale of equipment activity.

Outlook

Air Products confirms its previous fiscal 2024 full-year adjusted EPS guidance* of $12.20 to $12.50, up six to nine percent over prior year adjusted EPS. For the fourth quarter of fiscal 2024, Air Products' adjusted EPS guidance* is $3.33 to $3.63.

Air Products continues to expect capital expenditures* in the range of $5.0 billion to $5.5 billion for full-year fiscal 2024.

| *Management is unable to reconcile, without unreasonable effort, the Company’s forecasted range of adjusted EPS or capital expenditures to a comparable GAAP range. Air Products provides adjusted EPS guidance on a continuing operations basis, excluding the impact of certain items that management believes are not representative of the Company's underlying business performance, such as the incurrence of costs for cost reduction actions and impairment charges, or the recognition of gains or losses on certain disclosed items. It is not possible, without unreasonable efforts, to predict the timing or occurrence of these events or the potential for other transactions that may impact future GAAP EPS. Similarly, it is not possible, without unreasonable efforts, to reconcile forecasted capital expenditures to future cash used for investing activities because management is not able to identify the timing or occurrence of future investment activity, which is driven by management's assessment of competing opportunities at the time the Company enters into transactions. Furthermore, it is not possible to identify the potential significance of these events in advance, but any of these events, if they were to occur, could have a significant effect on the Company's future GAAP results. |

Earnings Teleconference

Access the fiscal 2024 third quarter earnings teleconference scheduled for 8:30 a.m. Eastern Time on August 1, 2024 by calling 773-305-6867 and entering passcode 2796775 or by accessing the Event Details page on Air Products’ Investor Relations website.